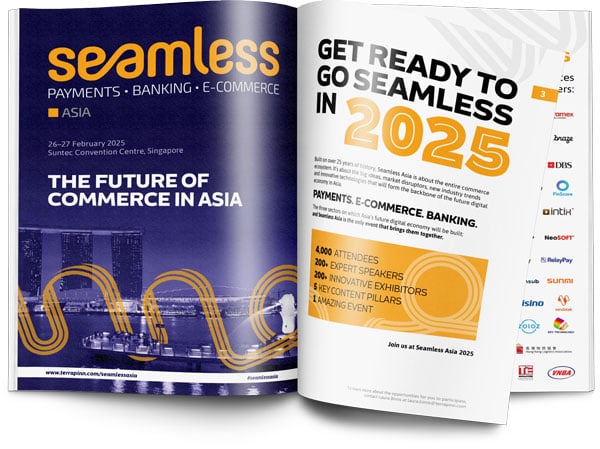

4,000+

Attendees

200+

Amazing Speakers

200+

Leading Sponsors & Exhibitors

Unlimited

Face-to-Face Networking Opportunities

WHAT IS SEAMLESS ASIA?

THE FUTURE OF COMMERCE IN ASIA

Built on over 25 years of history, Seamless Asia is about the entire commerce ecosystem. It’s about the big ideas, market disruptors, new industry trends and innovative technologies that will form the backbone of the future digital economy in Asia.

You don’t want to miss it.

Take a seat at the 2-day premium conference! This is your biggest opportunity to gain practical advice on Payments , Fintech (NEW!), Banking, E-Commerce and CX (NEW!)

A global showcase of cutting-edge technologies, products and solutions covering payments, banking, e-commerce and retail. Get ready to meet the teams behind the future of commerce in Asia. You won't want to miss this!

We facilitate quality networking opportunities through the various networking sessions arranged and the networking app to keep the conversation going. Exchange ideas and grow your professional network before, during and after Seamless Asia 2025.

ASIA’S LEADING BANKS, TELCOS, TRAVEL & HOSPITALITY COMPANIES, F&B OPERATORS, E-COMMERCE MARKETPLACES AND RETAILERS ATTEND SEAMLESS ASIA

Get Involved

This is your opportunity to engage thousands of payments, banking and e-commerce leaders.

5 THEMES. 1 SHOW

Emerging trends and novel strategies for online retailers in Asia

How Customer Experience technologies and trends are transforming digital commerce

A STELLAR LINE-UP OF INDUSTRY EXPERTS SPOKE AT SEAMLESS ASIA 2024

Want to know more about Seamless Asia series? We've got you.

Join our mailing list to receive exclusive content and offers.

By submitting, you agree to receive email communications from Terrapinn, including upcoming promotions and discounted tickets and news.

AVP, Head of Subsidiaries and Offshore Offices Compliance, BDO Unibank Inc.

APAC CISO, DWS (Deutsche Bank Asset Management)

Entrepreneur, JaKay Enterprise

APAC Regional Marketing Manager, Sumsub

Head of Strategic Partnership, Avensys Consulting Pte Ltd

Managing Director, Payments Consulting Network

Contact us

To Sponsor or Exhibit:

Laura Binns

Laura.binns@terrapinn.com

Speaking Opportunities:

Kathlene Mayuman

kathlene.mayuman@terrapinn.com

Eva Brauckmann

eva.brauckmann@terrapinn.com

Media & Partnership opportunities:

Jia Le Lim

jiale.lim@terrapinn.com